Technology has completely changed the way that transactions are carried out in today’s hectic corporate environment. These days, cashless transactions, credit card purchases in place of cash, and online document management systems are commonplace. For businesses to thrive in this digital age, establishing an online presence and having a business account is essential. Financial services streamline payment processes, offer exclusive benefits, and ensure secure transactions. This blog explores the advantages financial services provide for businesses, helping them adapt to modern demands and facilitate growth.

Find out more about the Financial Industry

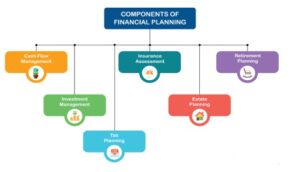

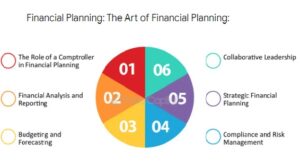

Financial services remain a fundamental component that assists in the improvement of business processes where international trade finance forms a key aspect and efficient management of cash flows. It also plays a crucial role in the economy and comprises various small businesses as well as large firms. Businesses may anticipate cash constraints and make proactive plans by developing comprehensive cash flow forecasts that estimate income and costs. Two crucial tactics are securing advantageous conditions for vendors’ invoices and making sure that customers pay on time.

Managing Finances

Whether you need to handle daily transactions, improve cash flow, or expand your business, these services offer resources like online platforms, mobile apps, expense management, payroll processing, business credit cards, and financial advice to support your needs.

Simplifying Payroll Management

Business financial services often include payroll processing, a crucial component that automates calculations, tax deductions, and direct deposits. This service saves time and minimizes errors or compliance issues for businesses. These tools enable timely salary payments and meticulous expense tracking, enhancing efficiency and reducing administrative burdens. By minimizing manual errors and processing delays, these services facilitate business growth and expansion, ensuring professional and systematic operations.

Getting Loans

Securing adequate capital for business projects and expansion is often challenging. Financial services offer diverse lending options tailored to meet business needs. Whether you need a term loan for expansion, a line of credit for working capital, or financing for entrepreneurs, these services provide flexible solutions to fuel business growth.

Using Tools

If managing finances manually is challenging, financial management tools can help businesses operate more efficiently, saving time and reducing costs. Online payment platforms enable real-time expense monitoring. Mobile apps facilitate payments and cash flow management. Accounting software simplifies financial management, and business debit cards provide control over spending.

Conclusion

Secure and timely payments are essential for company owners to prosper. It can be difficult to find reliable payment providers who provide both, but doing so is crucial to protecting transactions from fraud and cyber-attacks and maintaining regulatory compliance. Consulting with financial service experts like Joseph Stone Capital can further streamline your business transactions and pave the way for sustainable growth.

FAQs

Why the right Financial Services should be chosen?

Investing in reliable and secure business financial services can streamline cash flow, improve operational efficiency, and transform financial management.

Why Online platform is considered the best Financial service?

Online platforms provide seamless options for sending, receiving, tracking, and managing payments, enhancing operational efficiency.